The impact of the subsidy cut in 2017 has been highlighted. The new energy bus market has suffered severe setbacks. The annual examination results of major bus companies have become a big “bakeâ€.

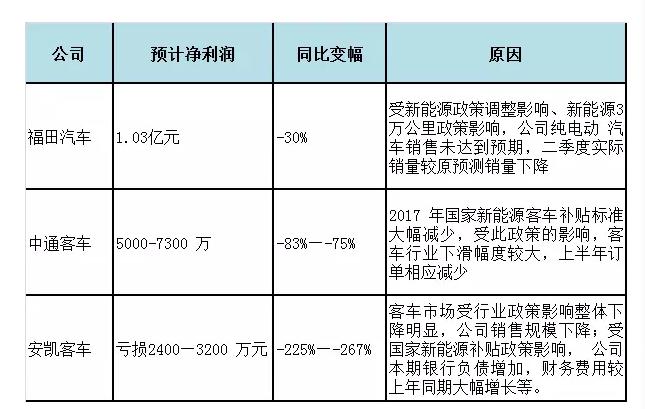

Up to now, Zhongtong, Foton Motor, Ankai Bus and others have successively released the first half of 2017 performance forecast. They all indicated that due to the impact of new energy policy adjustments, sales of new energy buses declined, and both performance and net profit declined. Some vehicles The company suffered a substantial loss. For example, Ankai bus is expected to lose between RMB 24 million and RMB 32 million in the first half of the year, a sharp drop of 225% to 267% year-on-year.

From 2017 onwards, the state officially reduced the subsidy for new energy vehicles, among which the maximum reduction for passenger cars was more than 50%. Not only that, since the end of 2016, the country has successively introduced a number of adjustment policies, major auto companies have to re-adjust the product strategy and production plan, and in accordance with national requirements for rectification. The entire new energy automobile market has been affected.

In addition to the above, Xiamen Golden Dragon Group, China's largest passenger car group, announced early on that the net profit attributable to shareholders of listed companies for the period from January to June 2016 was 164 million yuan. It is expected that the first half of 2017 will have a sharp decline in its performance and net profit. The reason is that the holding subsidiary Suzhou Jinlong was disqualified from the subsidy and was suspended from applying for the qualification of the recommended list.

( I) Bus sales in the passenger car market are frustrated

Since 2017, China's new energy bus market has suffered a setback and it did not begin to pick up until June. From a sales perspective, the total sales of new energy buses in China from January to June totaled 17,952, which was 47% lower than the first half of last year. The sales of major passenger car companies all fell substantially.

See the table below for details:

(b) Reasons for the bleak market

The senior electric car network learned from several bus companies that the new energy bus market in China from January to June was mainly affected by the policy adjustment, mainly including the subsidy cut, local subsidies not issued, and the 30,000 km indicator. aspect.

First of all, in 2017, the state began to subsidize the subsidies for new energy vehicles, including the reduction of passenger cars by as much as 50%. This has hit the bus market very hard. This part of the price difference is difficult to reconcile for a time, the buyer can not afford this part of the difference, car companies need a period of time to re-adjust the models, reduce costs, adjust prices.

Second, in the first half of this year, most local subsidy policies were not introduced. Because the subsidy standards are not clear, sales of new energy buses have caused great obstacles, and car companies are more concerned about selling vehicles.

Third, the 30,000-kilometer operating index is too high for commuter buses, because commuter cars basically take more than a year to complete 30,000 kilometers.

Among the 17,952 new energy buses sold in the first half of this year, the number of new energy buses was 12,959, accounting for a market share of 72%. The 30,000-kilometer mileage is generally half a year for buses.

Overall, compared to the bus market, the commuter bus market has been more severely affected.

For public transport vehicles, although the subsidies have been lowered, the government has tens of thousands of yuan per year in operating subsidies for buses. In addition, major bus groups buying new energy buses have financial support from local governments. At the financial level, the impact on the bus market is limited, and it is more because local subsidies are not clear.

However, for companies such as unofficial passenger transportation and leasing companies, subsidies have been lowered, prices have risen, and 30,000 kilometers have changed very sensitively.

(III) Market Recovery in the Second Half of the Year

As can be seen from the above, the sales of new energy buses by major bus companies from January to May are very sluggish, and they began to pick up in June. It can be judged that the new energy bus market began to pick up in June.

First, because the major car manufacturers have made cost control and model adjustments in response to policy adjustments and subsidy declines, the production planning has basically been completed;

Second, local policies are gradually being introduced and vehicle sales can be carried out normally. Thirdly, in the second half of the year, the procurement of bus companies will also start in batches, which will help stimulate the market. Fourth, major auto makers and operating units will launch a more optimized business model for subsidy reduction and 30,000 kilometers, which will greatly promote market sales. .

In addition, there are bus sales personnel revealed that the first two months, car companies received new energy bus orders began to increase, according to the order to delivery needs to be calculated nearly 2 months cycle, is expected to start in July and August this year, new energy passenger car Market sales began to increase.

A100 Anatase Titanium Dioxide,Titanium Dioxide,Anatase Tio2 Titanium Dioxide,Anatase Titanium Dioxide Tio2

Wuxi Qijun New Material Co., LTD , https://www.qijuncoating.com